At some point I am sure that you have probably heard the terms “digital currency”, or “cryptocurrency”, or “bitcoin.”

This form of currency has created wealth for many people that invested in it early on. This has also created a philanthropic wave but the problem is that many non-profits and churches are not equipped to receive a digital currency donation.

Well… we are set up!

How does a digital currency donation work?

Digital currency (sometimes called “cryptocurrency”) is a digital asset that functions as a medium of exchange, using cryptograpy to secure its transactions, to control the creation of additional units, and to verify the transfer of assets.

The IRS considers digital current be noncash property. If a taxpayer donates appreciated digital currency directly to a church or ministry, the appreciation in value is not subject to federal income tax. While the amount deductible by the giver will vary depending on the facts, if the giver held the digital currency for more than a year prior to the gift, the giver may be entitled to a deduction of the full fair market value of the digital currency contributed.

Churches and ministries should provide gift acknowledgments for gifts of digital currency as is appropriate for any other noncash gift. The gift acknowledgment should describe the gift (e.g., 40 Bitcoin units) and the date of the gift, but not the value of the gift. It is the responsibility of the giver to determine the fair market value of virtual currency in U.S. dollars as of the date of payment or receipt. If no goods or services were provided in exchange for the gift, the gift acknowledgment should state this. If goods or services were provided in exchange for the gift, the quid pro quo rules apply.

Givers could be required to file Form 8283 with their tax return, asking the donee church or ministry to sign Form 8283 acknowledging receipt of the gift. If a church or ministry is asked to sign Form 8283 in connection with a gift of digital currency:

- the giver should additionally be provided with a separate statement that no goods or services were provided in exchange for the contribution, if this is true, and

- if the digital currency is converted to dollars within three years of receiving it, Form 8282 must be filed within 125 days of converting it to dollars.

If churches or nonprofits accept digital currency gifts that are held or exchanged through an account outside of the U.S., IRS requirements for nonprofits and churches to report foreign bank accounts on Form TD F 90-22.1, Report of Foreign Bank and Financial Accounts (FBAR) may apply.

Giving Digital Currency

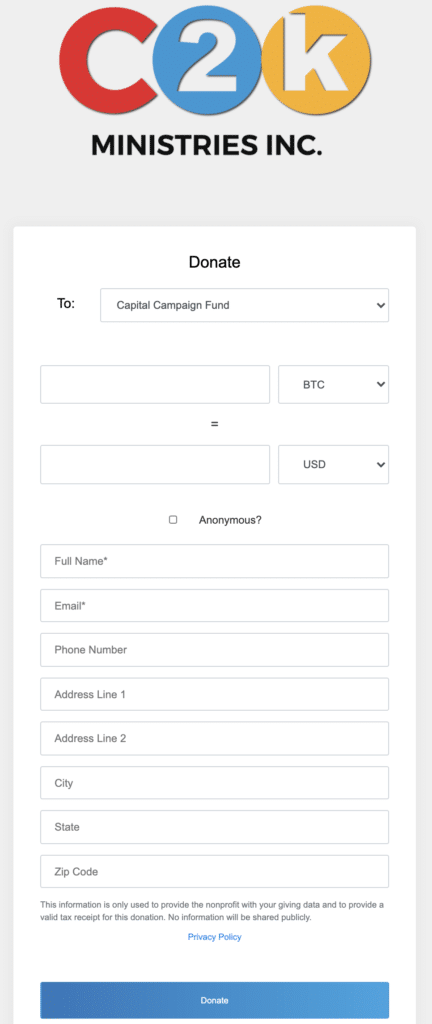

Just click the form below to be directed to our online platform for digital currency gifts. All transactions are secure and encrypted.